Author: Doug Johnstone, Principal Consultant at Digital Pivot

Date: February 2026

Author Perspective

I work with Professional services and Consulting leaders who are doing all the right things on paper – keeping delivery strong, maintaining customer relationships, and investing in marketing – yet they still see pipeline soften and win rates stall. The pattern is consistent: the market has moved, buyer expectations have moved, and the value that used to differentiate you is now easier to access, compare, and substitute.

AI has democratised access to knowledge, which means anyone with internet access can draw on global ideas, frameworks, and best practices in minutes.

AI is a major catalyst. It has lowered the cost of knowledge discovery and accelerated how fast customers form opinions before they talk to sales. At the same time, AI is non-deterministic, which means organisations cannot outsource judgement to machines and walk away. The winners will be the firms who use AI to sense market movement early, then use humans to make the hard calls on positioning, offer design, and go-to-market execution. (hai.stanford.edu)

Outline

- AI democratises knowledge and compresses buying cycles

- Markets shift when customer outcomes shift

- Product market fit is now a moving target

- AI helps sense drift before revenue drops

- Non-determinism keeps humans in the loop

- A repeatable process beats ad hoc reinvention

- What “Offering Pivot” looks like in practice

- Next steps to evaluate your own fit

Key Takeaways

- Knowledge is cheaper, differentiation must evolve

- AI changes customer expectations and evaluation speed

- Product market fit needs continuous validation

- Measure fit by outcomes, not internal capability

- Use AI to detect demand and message drift

- Keep human judgement for critical decisions

- Rebuild offers around buyer journey outcomes

- Pivot early to protect relevance and growth

Introduction

We are all experiencing a profound shift in the knowledge economy. AI has democratised access to knowledge, which means anyone with internet access can draw on global ideas, frameworks, and best practices in minutes. That shift is changing how people work and, in turn, redefining markets.

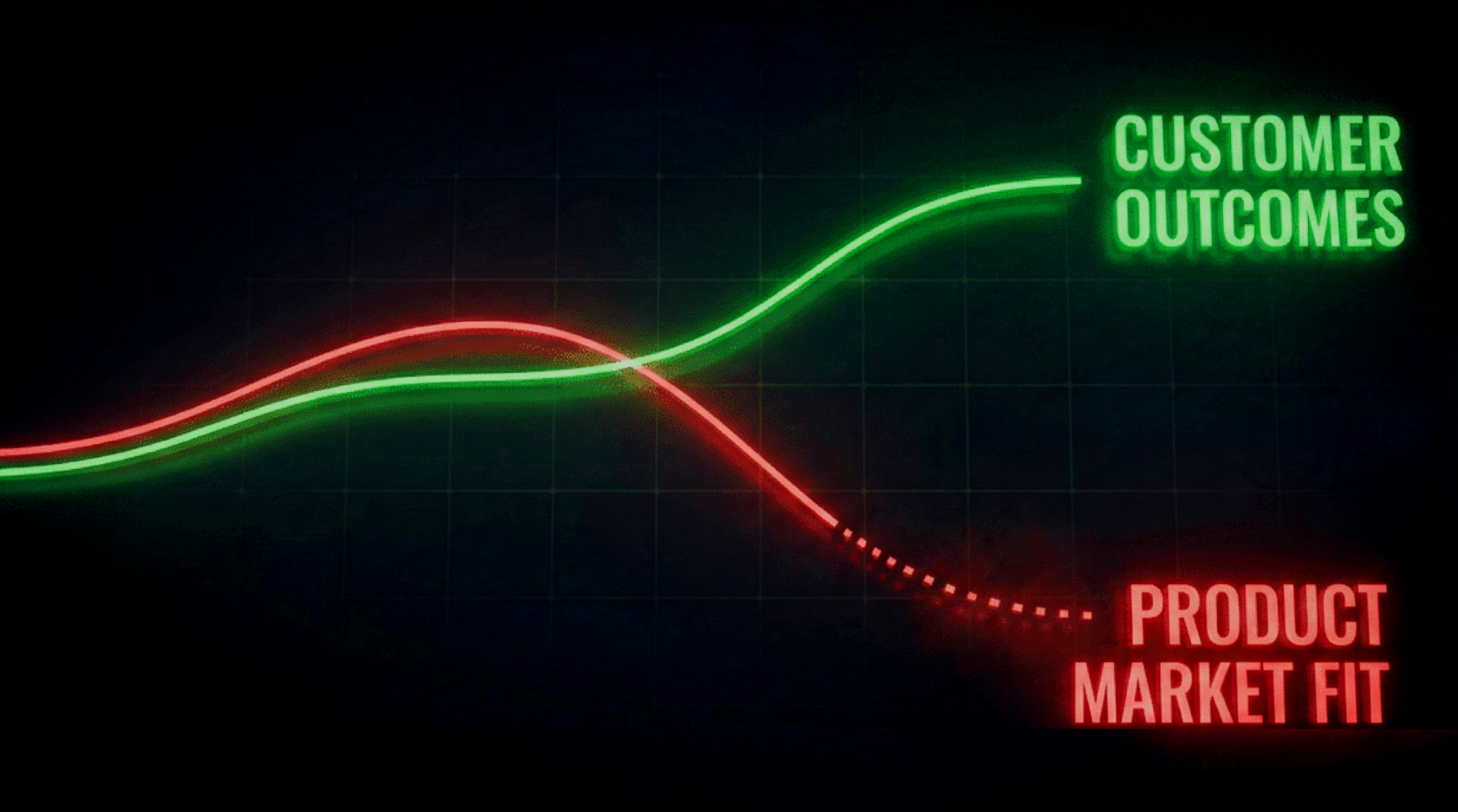

In B2B services, a market is best understood as a set of customer outcomes. When the outcomes customers want change, or when the pathway to those outcomes changes, the market changes. That is why product market fit is no longer something you “achieve” and then defend. It is something you continuously monitor, because the ground is moving under your feet. AI is a key driver of that movement, and the practical response is to use AI to help sense and respond to change, while still keeping humans in the loop for high-stakes judgement. (OECD)

AI Is Compressing the Knowledge Advantage

For decades, many professional services firms benefited from an information advantage. You knew the vendors, the patterns, the pitfalls, the procurement process, and the implementation realities. Customers relied on you to translate complexity into outcomes.

AI is steadily eroding that gap. Buyers can now:

- compare approaches quickly

- generate shortlists and evaluation criteria faster

- test ideas internally before engaging a provider

- access “good enough” answers without paying for discovery

This does not eliminate the need for expert services. It changes where the value sits. Value shifts away from “knowing the thing” and towards: diagnosing the right problem, applying judgement in messy contexts, orchestrating change across people/process/technology, and delivering outcomes with accountability. AI accelerates capability transfer, which means your differentiation must become more outcome-specific and harder to copy. (OECD)

Product Market Fit Has Become a Continuous Discipline

In software, product market fit is often framed as “a product that satisfies a strong market demand.” In services, fit is more nuanced, but still measurable. It shows up as:

- customers recognising the problem you solve as urgent

- your offer being easy to explain and easy to buy

- sales cycles shortening (or at least not expanding)

- conversion rates holding under competitive pressure

- delivery leading to repeatable outcomes and referrals

The risk is that many firms judge fit using internal signals (what we are good at, what we have always sold, what delivery is staffed for) rather than external signals (what outcomes customers now prioritise, what alternatives they consider, and what language they use to justify spend).

Digital Pivot calls this the “value gap” – when what customers want and what you are currently positioned to deliver drift apart over time. In an AI-shaped market, that drift can happen faster than most leadership teams expect. (digitalpivot.co.nz)

The Tipping Point: AI Adoption Is Now Mainstream, But Value Capture Is Uneven

A useful way to think about “the tipping point” is adoption plus behavioural change. Multiple large studies indicate rapid expansion of AI usage in organisations and growing investment momentum. (hai.stanford.edu)

But adoption does not automatically translate into value. Many organisations experiment without rewiring workflows, governance, and measurement. The practical implication for marketers and GTM leaders is this: the market is fragmenting into buyers who are AI-enabled (faster, more informed, more demanding) and buyers who are still catching up. Your messaging, proof points, and offer packaging must work for both groups without becoming generic.

This is where continuous product market fit evaluation becomes a competitive discipline, not a quarterly strategy exercise.

Why AI Forces Humans to Stay in the Loop

AI systems, especially generative AI, can be non-deterministic. That means the same prompt can yield different outputs, and the system can produce convincing but incorrect content. This is not a minor flaw. It changes how you must design marketing, sales, and delivery processes that rely on AI.

In practice:

- AI can accelerate research, synthesis, segmentation, and content production

- AI can help detect patterns in voice-of-customer data at scale

- AI can suggest hypotheses about positioning, pain, and objections

But humans must remain accountable for:

- claims, proof, and compliance

- strategic trade-offs (where to play, how to win)

- customer-specific context and political reality

- decisions that carry reputational or financial risk (NIST)

For B2B marketing, this is actually good news. It reinforces the importance of insight, judgement, and narrative. AI can help you move faster, but it does not remove the need for thinking.

A Practical Model: Use AI to Sense Drift, Then Use Humans to Pivot

If product market fit is now dynamic, you need a practical loop to manage it. Here is a field-tested way to structure that loop in a services business:

1) Sense market movement early

Use AI-enabled signals to detect change before revenue declines:

- shifts in search behaviour and AI answer visibility

- changes in RFP language and evaluation criteria

- competitor repositioning and new bundles

- customer calls that include new constraints (budget, risk, compliance)

- declining engagement on previously effective content

The goal is not to “predict the future.” It is to identify drift early enough to respond deliberately.

2) Re-validate outcomes and urgency

Interview customers and lost deals to confirm:

- which outcomes matter most now

- what is driving urgency (risk, cost, growth, regulation)

- what “proof” buyers require to believe you

- what alternatives they are considering

AI can accelerate synthesis, but humans should lead interpretation and decision-making.

3) Rebuild the offer around the buyer journey

This is where many firms struggle. They jump to a new capability (a new vendor certification, a new tool, a new packaged service) without re-anchoring on outcomes and buying behaviour.

A stronger approach is to package the offer so it maps to:

- the customer’s stage in the buying journey

- the evidence needed at each stage

- the commercial model that reduces perceived risk

- the delivery approach that makes outcomes repeatable

This aligns closely to Digital Pivot’s focus on reshaping go-to-market strategy and offerings to close the value gap and reignite demand. (digitalpivot.co.nz)

4) Operationalise learning, not just strategy

Fit is maintained by cadence:

- monthly review of market signals and pipeline conversion (CiteCompass)

- quarterly offer performance and win-loss insights

- continuous content refresh based on real objections and questions

This is where many teams win back momentum, because they stop relying on occasional big “rebrands” and start running an evidence-led loop.

Where “Offering Pivot” Fits

Offering Pivot is best understood as a structured method to realign your service portfolio and go-to-market when the market has moved or when growth has stalled. It focuses on diagnosing where fit has drifted, identifying the highest-demand outcomes to pursue, and reshaping offers so they are differentiated, easy to buy, and aligned to the buyer journey. (digitalpivot.co.nz)

If you are seeing any of these signals, you are likely due for a pivot cycle:

- strong delivery, but weakening new pipeline

- increasing price pressure and more competitive bake-offs

- marketing activity up, but conversion down

- sales conversations stuck in “we do everything” positioning

- customers asking for outcomes you do not package well today

Next Steps

- Assess your current product market fit signals: pipeline quality, win-loss patterns, buyer objections, and customer outcome language.

- Identify where knowledge has commoditised: what buyers can now self-serve with AI, and what that means for your differentiation.

- Run a human-led, AI-assisted discovery loop: combine interviews, deal data, and market signals to diagnose drift.

- Reshape one offer first: prioritise the offer with the highest near-term demand and clearest route to proof.

- Build a cadence: treat fit as a managed discipline, not a one-off workshop.

How do I get started with Offering Pivot?

Download a Brochure here with an overview of the Offering Pivot process

Or book a call today with one of our advisors here

Further reading on to pivot your offerings into growth markets.

- Now is the time for Businesses to Pivot and Hustle

- Pipeline vs Market Fit: Which Matters More?

- Know when to re-align your entire portfolio strategy?

- What is the underlying cause of the decline in service demand?

- How do I Align Services with Evolving Client Needs?

- What is the Roadmap to Successful Portfolio Diversification?

- How do I measure the success of a Service Offering Pivot?