Author: Doug Johnstone, Principal Consultant at Digital Pivot

Date: October 2025

Introduction:

I’ve spent the better part of my career helping B2B service providers across New Zealand and Australia generate demand for professional and managed services. Lately, I’ve noticed a pattern: more and more clients are coming to us not because one product is underperforming – but because their entire portfolio of offerings is losing traction. When that happens, the answer isn’t to throw more budget at marketing or tweak one solution. It requires stepping back, reassessing the fundamentals, and making bold choices. I’ve guided several leadership teams through this kind of transformation using the Playing to Win strategy framework, and it’s proven to be one of the most powerful tools for realigning with what the market actually values. In this article, I’ll share the signs that it’s time to pivot and the strategic steps to realign your offerings to win—before the market forces your hand.

Key Takeaway:

When your portfolio starts to underperform, don’t treat it like a marketing problem—treat it like a strategy problem. Using the Playing to Win framework helps you pivot with purpose by making smart, aligned choices about where to play and how to win. The result? An offering mix that’s relevant, differentiated, and designed to close deals—not just open doors.

Outline:

- What Is a Portfolio Pivot in B2B Services?

- Definition and why it’s different from a product tweak

- When and why B2B leaders should consider one

- How to Spot the Signs You Need a Pivot

- Red flags: stagnant growth, value gaps, customer churn

- Examples from the field

- Using the Playing to Win Strategy Framework

- The 5 key choices explained

- Why it’s ideal for guiding high-stakes strategic shifts

- Case examples of it in action

- Executing a Successful Portfolio Pivot

- Market research and value gap analysis

- Offer redesign and capability alignment

- GTM realignment and measurement

- Brand, Fit, and Differentiation—By Design

- Your signature mantra unpacked

- How each element supports the pivot

- Why you need all three working in sync

- Conclusion

- Final thoughts and call to action for B2B leaders

- Link to blog and resources for next steps

Background:

In the fast-changing B2B landscape of New Zealand and Australia, even the most robust strategy will eventually need a course correction. New technologies emerge, competitors make bold moves, and customer expectations evolve. One of the few certainties of management is that at some point every go-to-market strategy requires a pivot or realignment[1].

For B2B service providers, this often means undertaking a portfolio pivot – reassessing and realigning your entire offering strategy to close the “value gap” between what you deliver and what your clients truly need. But how do you know when to pivot, and how can frameworks like the Playing to Win strategy framework guide you through the process? This article breaks down the signs that it’s time to pivot and offers a structured approach (with clear where-to-play and how-to-win choices) to realign your B2B offerings for sustained success in the ANZ market.

What is a Portfolio Pivot in B2B Services?

A portfolio pivot in B2B services is a strategic realignment of your company’s offerings – essentially changing “where you play” or “how you win” in the market to better meet demand. Unlike a minor product tweak or a marketing campaign change, a portfolio pivot involves rethinking your offering strategy at a fundamental level. It could mean adding new service lines, discontinuing or reinventing legacy offerings, or repositioning to target different customer segments. In short, it’s about shifting the mix of services (your portfolio) to align with a new strategic direction.

This concept has gained prominence as businesses recognize that simply doing more of the same can lead to stagnation when the market shifts. A portfolio pivot is often proactive, not reactive – the goal is to get ahead of changing trends and close any gap between the value customers seek and the value you currently provide (the “value gap”). Done right, an offering pivot can reignite demand and put your company on a path to renewed growth. Done haphazardly, however, a pivot can confuse the market or dilute your competitive advantage. The key is to pivot with purpose and strategy, not on a whim.

Why B2B Go-to-Market Strategies Must Evolve (Knowing When to Pivot)

Even the best-crafted B2B go-to-market strategy will face inflection points where continuing with the status quo is riskier than changing course. In the Australia/New Zealand business context, we’ve seen rapid shifts in client needs and technology adoption that force services firms to adapt. Many IT and professional service providers, for example, have experienced declining demand for traditional offerings due to market saturation, commoditisation, or technology shifts[2]. If core services become outdated or over-competitive, it’s a signal that realignment is needed to pursue new growth markets and revenue streams[2].

Here are some common signs it’s time to consider a portfolio pivot in your B2B business:

- Stagnant or Falling Growth: If your once-reliable offerings have hit a growth ceiling or revenues are declining, it may indicate market saturation or a mismatch with emerging client priorities. As Digital Pivot’s research on the ANZ IT sector shows, sticking solely to yesterday’s services in a changing market can leave growth on the table[2]. A pivot can open new revenue streams by targeting high-demand areas.

- Customer Value Gap: A clear “value gap” exists when there’s a disconnect between what your clients value most and what you deliver. Perhaps clients are now seeking outcomes or capabilities that your current portfolio doesn’t address. If you’re hearing requests for services you don’t offer, or if key clients are leaving for competitors with different solutions, it’s a red flag. In one notable case, furniture maker Herman Miller found that some large clients no longer valued an expensive design consultation service that had been a core part of its offering – those clients felt they were paying for something they didn’t need[3]. This revealed a value gap in Miller’s portfolio. The company responded by pivoting to provide a simplified offering without the unwanted feature, tailored for that client segment[4]. The lesson: when your offering strategy provides less value than clients expect, a pivot (however difficult) becomes necessary.

- Competitive Pressure and Market Shifts: If a competitor’s new offering is luring away your customers, or disruptive technology changes the game, you might need to pivot to regain an edge. For instance, the rise of cloud services in the tech industry forced many traditional IT service providers to pivot their portfolios toward cloud consulting, security, and managed services. Failing to realign fast enough when the market shifts can mean falling behind in relevance.

- Internal Misalignment or Strategy Drift: Sometimes the impetus to pivot comes from within. If your sales team is struggling to sell an aging service, or if delivering certain offerings is increasingly unprofitable, these are signs of strategic drift. A go-to-market realignment may be required to refocus resources on what you can win at. The goal is to change the means to achieve your goals, not the goals themselves[1] – in other words, pivot how you’ll reach your business objectives while keeping your overarching mission steady.

In today’s environment, agility and rapid adaptation are critical leadership skills[1]. Being willing to pivot – at the right time – is part of that agility. The decision should never be taken lightly, but neither should it be avoided out of complacency. The next question is how to pivot strategically rather than randomly. This is where a proven strategy framework comes into play.

Playing to Win Strategy Framework: Guiding Your Pivot Decisions

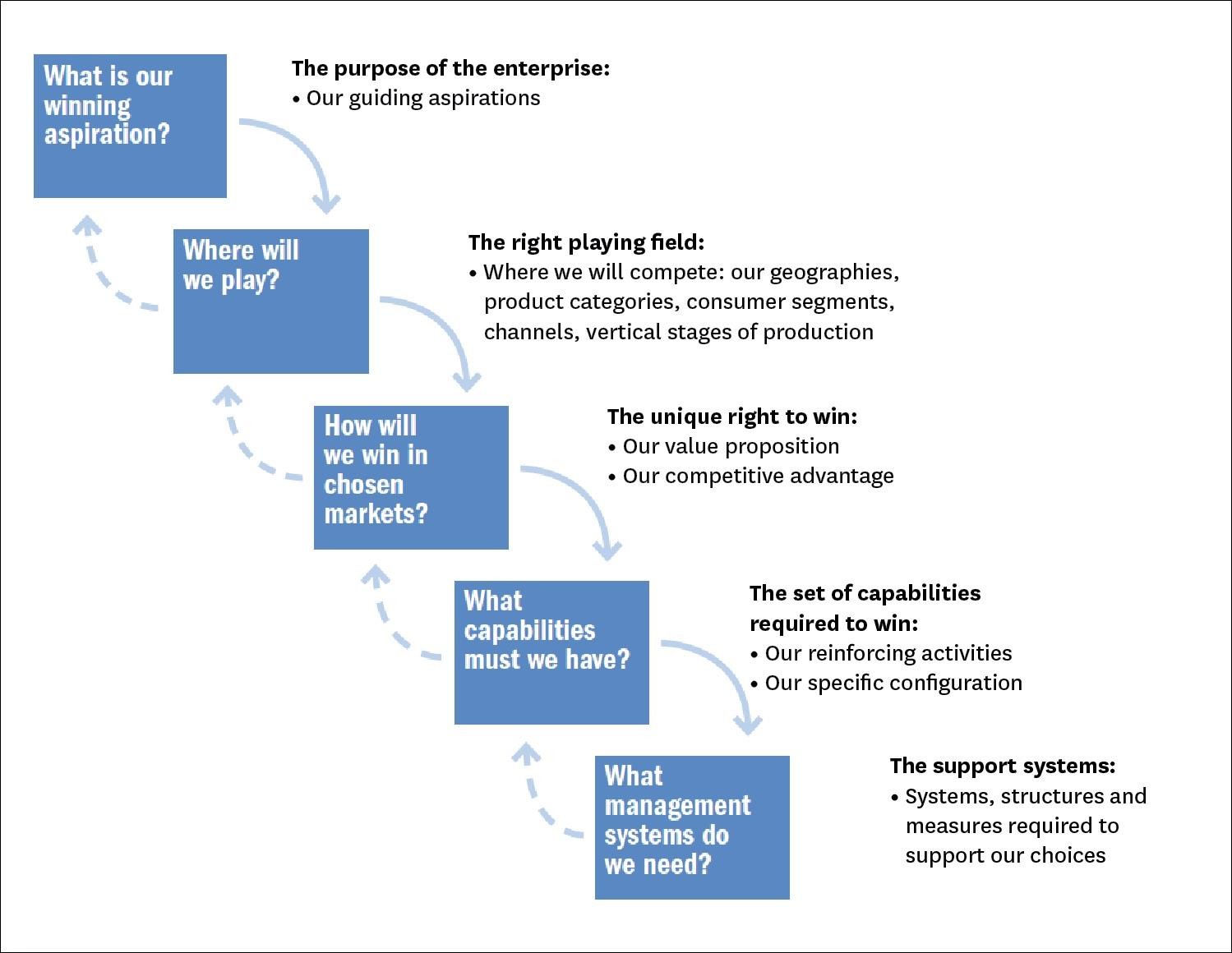

When considering a major realignment of your offerings, it helps to anchor your thinking in a solid strategy framework. One of the most respected in recent years is the Playing to Win strategy framework, developed by former P&G CEO A.G. Lafley and strategist Roger L. Martin. At its core, Playing to Win defines strategy as a coordinated set of five key choices: (1) a winning aspiration, (2) where to play, (3) how to win, (4) core capabilities needed, and (5) management systems required[5]. These five questions form a strategy cascade that ensures all aspects of your plan align toward winning.

For a portfolio pivot, the where to play and how to win choices are especially pivotal (pardon the pun). Essentially, deciding to pivot your offering mix means redefining where you will compete (which services, which markets or segments) and how you will win in those areas (what differentiators and value propositions you’ll deploy). The Playing to Win framework insists that these choices be specific and reinforcing[5]. Simply declaring a generic goal to “innovate our offerings” is not enough – you need to clarify what game you’re going to play and how you’ll win that game.

Roger Martin himself cautions that not all pivots are created equal. “A pivot is a good thing only if it shifts a company from a weak where-to-play/how-to-win choice to a powerful one,” Martin writes[6]. In other words, don’t pivot for pivot’s sake or as a panic move. Changing direction just because current results are underwhelming can be dangerous unless the new direction is based on a stronger strategic logic than the last. Before you pivot, use the Playing to Win questions (or a similar strategic lens) to stress-test your current strategy and identify where the real weakness lies.

Ask yourself: If we continue with our current offering strategy, what must be true for it to succeed? (This is known in the framework as identifying the “What Would Have to Be True” conditions.) If a core assumption behind your strategy is failing – e.g. customers aren’t responding as expected, the target segment isn’t as large or lucrative as needed, or competitors are neutralizing your advantage – then you have evidence that a pivot is in order[7]. Crucially, the nature of the failed assumption can hint at how you need to pivot. In the Herman Miller example, the assumption “customers highly value our design advice bundled with products” became false over time[3]. That pointed to a specific pivot: separate the design service from the product offering for those who don’t want it[4].

By using a structured framework like Playing to Win, you ensure your portfolio pivot is grounded in strategic insight rather than guesswork. You’ll pivot with a clear view of your new playing field and a credible plan to win. The framework forces clarity about your choices and helps avoid the trap of “random acts of pivoting” (making frequent, unfocused changes that confuse the market). Instead, you are deliberately moving from a less competitive position to a more competitive one.

How to Realign Your Offering Portfolio (Steps to a Successful Pivot)

Once you’ve decided that a portfolio pivot is necessary, the next challenge is execution. Realigning a B2B offering strategy is a complex undertaking – it’s essentially a mini-transformation project for your business. However, by breaking it into clear steps, you can manage the pivot in a structured way. Below is a roadmap that B2B C-suite leaders can use to pivot offerings systematically:

- Reassess Market Needs and Identify Opportunities: Start with outward focus. Conduct fresh market research to observe emerging trends and uncover gaps in client needs. Look at industry reports, client feedback, and competitor moves for signals of unserved or under-served demands. Engaging with key customers in New Zealand and Australia can reveal regional trends – for example, shifts toward digital services, sustainability requirements, or post-pandemic operating model changes. The goal is to pinpoint where the demand is moving, so you can align your portfolio accordingly. Tip: Analyse where your competitors are investing and listen to what your clients are asking for (or complaining about). Unmet needs are the seeds of your next offering. (Where to play? This research guides you to the right arenas.)[8]

- Evaluate Your Value Gap: As you scan the market, perform an honest evaluation of your current offerings versus customer expectations. Where are you falling short on delivering value? This is the essence of the value gap analysis. Maybe your services are too generalized and clients now seek specialized expertise, or perhaps response times and digital delivery are now as important as the core service itself. Rank each offering: is it high value (to customers) or becoming low value? This exercise will illuminate which offerings may need to be pruned, enhanced, or completely reimagined. It also highlights new value propositions you’ll need to develop to remain relevant. In short, identify the gaps between what the market values and what you provide, and zero in on the gaps worth filling through a pivot.

- Assess Organisational Capabilities and Fit: Any new strategic direction must align with (or deliberately build) your company’s capabilities. Take stock of your internal strengths, assets, and limitations. What are you really good at, and what new capabilities would a pivot require? For instance, pivoting to a cloud-based offering might demand new technical certifications or partnerships; targeting a new industry may require domain experts on your team. Perform a capability audit to see what you have and what’s missing[9]. Be realistic about the investment or acquisition required to fill gaps. An effective portfolio pivot leverages some of your existing core competencies to enter adjacencies, rather than leaping into areas far removed from your experience. (What capabilities must be in place? This ties back to the Playing to Win framework[5].)

- Define the New Offering Strategy: With market opportunities identified and an understanding of your capabilities, design the new portfolio mix and value propositions. Clarify your winning aspiration – what success looks like after the pivot (e.g. becoming the ANZ region’s go-to provider for X service). Then articulate the specific services/solutions you will offer (where to play) and how they will win clients (how to win) in that space. For each new or realigned offering, craft a compelling value proposition: what client problem does it solve and how is it distinct? Also decide what you’ll stop doing; part of realignment is often discontinuing low-value offerings to free up focus. This step is essentially your strategy redesign, so involve your leadership team, and consider using strategic tools like a strategy canvas or value proposition canvas to map it out. By the end, you should have a clear map of your future portfolio and the strategic logic behind it.

- Align Your Go-to-Market Strategy: A portfolio pivot isn’t just a product change; it’s a full go-to-market realignment. This means updating your marketing messaging, sales approach, and possibly business model to reflect the new offerings. Ensure your sales teams understand the new value propositions and provide them with enablement materials to sell effectively (playbooks, case studies, demos, etc.)[10]. Marketing should refresh your brand positioning and content to emphasize the pivoted strategy (for example, producing thought leadership on the new solution area, updating your website to highlight your new focus, etc.). If you have channel or alliance partners, bring them into the loop so they can support your go-to-market. Internally, break down any silos – product, marketing, and sales need to be in lockstep on the new direction. In the context of NZ/Australia, localize your go-to-market as needed (different industries or business cultures in Australia vs New Zealand might require tailored approaches).

- Execute, Measure, and Iterate: With plans in place, launch your pivot initiatives and closely track performance metrics. Determine what success looks like in the short term – e.g. a certain number of pilot customers for the new offering in the first 6 months, or a target percentage of revenue from new services in year one. Monitor KPIs like client acquisition rate, retention, revenue growth in the new segments, and customer feedback on the revamped offerings[12]. This data will tell you if the pivot is yielding results or if further tweaks are needed. Be prepared to iterate: perhaps one element of the new strategy isn’t resonating, or an assumption was off – that’s okay. The beauty of a well-planned pivot is that you can adjust course without losing the overall strategic intent. Regular strategy reviews (quarterly, for example) will help ensure your offering strategy remains aligned with the market. In a dynamic business environment, strategy is an ongoing process, not a one-time set-and-forget. The Playing to Win framework can be revisited to fine-tune choices as conditions evolve.

Throughout these steps, maintain a balance between bold vision and prudent risk management. Pivoting your portfolio is a big move, but it should be executed in manageable phases. You might start with a pilot program or a specific industry focus in Australia or NZ to test the waters before a full-scale rollout. And importantly, keep communicating – to your team (so they understand the “why” and “how” of the pivot) and to your customers (so they see the pivot as adding value for them).

(For further reading on aligning services with client needs, see our piece on bridging the value gap on the Digital Pivot blog.) 📖

Conclusion: Pivot with Purpose to Close the Value Gap and Win

In the end, a portfolio pivot is about playing to win in a new way. It’s an opportunity to step back, question fundamental assumptions, and reposition your company for the future. Far from being a sign of failure, a strategic pivot is often a proactive move to unlock new growth and strengthen your market positioning[13]. By keeping your focus on customer value (closing that value gap) and using frameworks like Playing to Win to guide tough choices, you ensure that your pivot isn’t just change for the sake of change – it’s change that builds a more competitive and resilient business.

For B2B leaders in New Zealand and Australia, the message is clear: staying static is not a winning strategy in the long run. The market will continue to evolve, and so must your offerings. The good news is that with the right strategy and timing, a portfolio pivot can realign your go-to-market approach with what clients truly need, today and tomorrow. In doing so, you reaffirm your winning aspiration and set the stage for sustainable growth.

Remember, pivoting (when justified by strategic insight) is playing to win – not just participating. By realigning your entire offering strategy thoughtfully, you ensure your company is positioned to compete and win in the arenas that matter most. Now is the time to evaluate your portfolio, listen to the market, and make the strategic pivots that will keep you ahead of the curve.

For expert guidance on executing your Offering Pivot, reach out to Digital Pivot today.

For more information, contact us

Key steps to pivoting your offerings into growth markets:

- Pipeline vs Market Fit: Which Matters More?

- What is the underlying cause of the decline in service demand?

- How do I Align Services with Evolving Client Needs?

- What is the Roadmap to Successful Portfolio Diversification?

- How do I measure the success of a Service Offering Pivot?

- Knowing when to re-align your entire portfolio strategy